|

28.01.2021 06:45:00

|

BNP Paribas: Water - a pervasive resource and a portfolio staple

What are the main investment opportunities related to water?

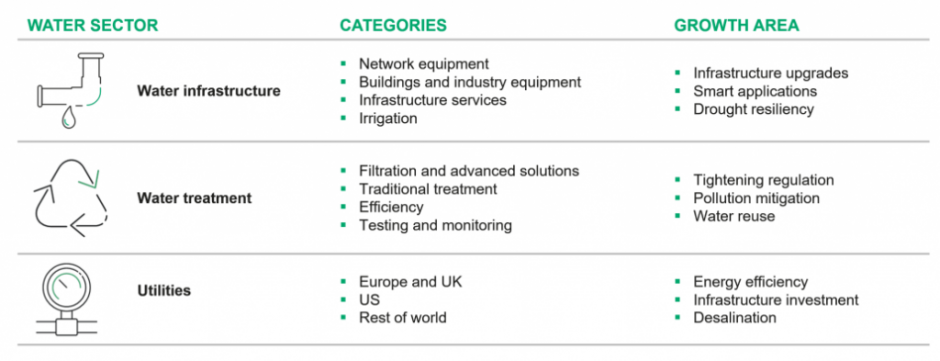

We have been investing in the transition to a more sustainable economy for more than 20 years. This has always included water, so we have built up considerable experience in this field. In water-related investing, we see three broad areas:

- Water infrastructure

- Water treatment

- Water utilities.

Water infrastructure is particularly important at the moment: we expect strong growth in this area in the next few years with numerous – and diversified – opportunities for investors.

In developed markets, there is ongoing demand for water infrastructure because in many countries water networks are dilapidated and need upgrading, if not replacing. This is important: millions of litres of water are lost due to leakage. In addition, outdated systems can present health risks.

In emerging markets, particularly in India and China, which are developing and becoming richer, there is a need for more water infrastructure. Millions of people are moving to the cities and this growing urbanisation means more demand for clean and healthy water, but also for wastewater treatment. Clearly, there are growth opportunities here although for now, our focus is on North America and Europe.

Exhibit 1: Investment opportunities related to water

Source: Impax Asset Management, BNP Paribas Asset Management

We have always needed water and that is not going to change. Water is used in everything that is produced, from smart phone production with the help of ultra-clean water to clothing and paper. Water is not a commodity that can be easily substituted or displaced; it cannot be disrupted by technology as fossil fuels can. There is a finite amount of fresh water and increasing demand, making water and water-related techniques and solutions a growth market.

How do you expect the US elections result to affect investment in water infrastructure?

We believe the political situation in the US has developed in a positive direction. Now that the Democrats are effectively in the White House and have control of Congress, we can expect more initiatives and investment to address sustainability issues including water. Flood prevention and water retention are examples of areas that are likely to be the focus of more attention. That bodes well for equipment providers and consultants.

In terms of water infrastructure, there are many regions with poor systems, particularly in the Deep South. We can expect concerted efforts to address these deficiencies. Another example concerns system quality. You may have heard about the situation in Flint, Michigan, where lead from lead pipes seeped into the drinking water. This had serious health implications, especially for children.

This situation is not unique. We expect the incoming administration to be more open to solving these problems. In fact, we think that the conditions for increased spending on water issues in the US have not been this good for many years. That also means the conditions for investing in water are now much more positive.

New regulation and its impact on investing in water

We expect regulations and legislation to have a much more positive impact on the opportunities around water investments. This will be part of a wider focus by consumers, governments and regulators on product quality, hygiene and safety standards. The previous US administration did not want to address many environmental issues, but the new one will. This is not just about lead in water lines, but also about a policy to address the use of PFAS, or ‘forever’, chemicals. They are used in many areas, including firefighting and waterproofing. Once they seep into the environment, they persist.

We expect the new US administration and governments in Europe and APAC to make dealing with PFAS a priority. This means demand for testing equipment, laboratory services and equipment and services to remove the contaminants. Similarly, the issues around micro-plastics will grab attention.

Overall, and this is the case globally, there is an increased awareness of such problems, and the risks they represent to business and society. Investing in high quality companies that deal with them means investing not only in multi-billion dollar growth areas, but also a better future.

Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions).

Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

Der finanzen.at Ratgeber für Fonds!

Der finanzen.at Ratgeber für Fonds!

Wenn Sie mehr über das Thema Fonds erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!