|

03.11.2016 23:38:00

|

TMAC Resources Nears Production at Hope Bay

TMAC Resources Inc. (TSX:TMR) ("TMAC” or the "Company”) filed its Condensed Interim Financial Statements and Management’s Discussion & Analysis ("MD&A”) for the periods ended September 30, 2016, which documents can be found on the Company’s website at www.tmacresources.com or on SEDAR at www.sedar.com. The highlights provided below are derived from these documents and should be read in conjunction with them.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20161103006887/en/

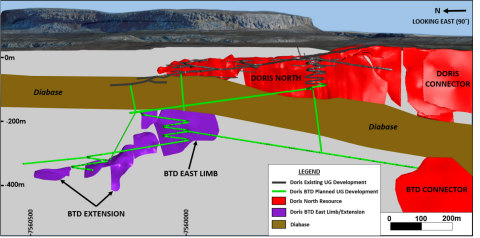

Figure 1: Doris North BTD Zone location of the planned access ramp and additional exploration areas accessible for underground diamond drilling. (Graphic: Business Wire)

THIRD QUARTER 2016 HIGHLIGHTS

Hope Bay Project

- Mining and mine development, productivity and ore production were on target. Mining and mine development continued with 83,800 tonnes having been mined in the third quarter of 2016, compared with the planned 72,400 tonnes. Productivity increased to above 0.5 metres per man-shift, exceeding the estimates published in the Pre-Feasibility Study ("PFS”). Ore production was 32,200 tonnes at an estimated grade of 16.1 grams of gold per tonne ("g/t”) of gold.

- Including ore mined in late 2015 and ore mined by the previous operator, the stockpile is estimated to contain 89,100 tonnes of ore at a gold grade of 14.7 g/t, or 42,100 ounces of gold of which 39,500 ounces of gold are recoverable at the estimated recovery rate of 94%.

- The processing plant (the "Processing Plant”) fabricated by Gekko Systems Pty of Ballarat, Australia ("Gekko”) was successfully and safely delivered to Hope Bay by August 30, 2016 and installation thereof is progressing in line with plan.

- All remaining essential mining equipment, diesel fuel, materials and supplies, and reagents required for production of gold in early 2017 were delivered to Hope Bay in the 2016 sealift.

- Construction of the building that will house the Processing Plant (the "Mill Building”) progressed with 100% of the Processing Plant enclosure constructed at September 30, 2016. The cladding for the crushed ore stockpile enclosure was completed in October 2016.

- As part of the Nunavut Impact Review Board’s ("NIRB”) and Nunavut Water Board’s ("NWB”) regulatory review process of the application to amend the Doris environmental permits (the "Doris Permit Amendments”), TMAC received the amended NIRB Project Certificate on September 23, 2016 and an amended Water Licence is expected to be provided by NWB to the Minister for Indigenous and Northern Affairs Canada ("INAC”) in early November 2016 for review.

- Staffing and recruiting is proceeding as planned.

In connection with the assembly of the Processing Plant we have posted a video to YouTube and invite interested parties to access it at the following link https://youtu.be/5meL6KbtKsc.

Financial and Corporate

- On July 7, 2016 and September 26, 2016, TMAC drew down additional amounts of US$35 million and US$15 million, respectively, under the US$120 million debt facility (the "Debt Facility”) upon receiving waivers from the Lenders with regards to the receipt by the Company of the Doris Permit Amendments. A balance of US$20 million remains to be drawn.

- On July 19, 2016, TMAC completed a bought deal financing of 3,975,000 Common Shares from the Company at a price of $15.10 per Common Share for gross proceeds of approximately $60.0 million (the "Bought Deal Financing”). Net proceeds of $56.5 million were received by the Company.

Dr. Catharine Farrow, Chief Executive Officer of TMAC, stated, "We remain on track and essentially on budget with our progress to advance the Hope Bay Project towards commercial production in early 2017. As of this week, we are approximately 89% complete with construction and assembly and have spent 88% of the amount estimated in the Path to Production plan. TMAC remains focused on executing this critical stage in our evolution as we build the first gold mine in what we believe to be Canada’s next gold mining district.”

2016 OBJECTIVES

TMAC expects to achieve all of its following objectives.

Hope Bay Project

- Deliver the Processing Plant and mobile equipment in the 2016 sealift.

- Complete erection of the Mill Building and the installation of associated services.

- Complete the installation of and initiate commissioning of the Processing Plant.

- Complete preparation of the tailings impoundment area to receive tailings.

- Stockpile, by December 31, 2016, 110,700 tonnes of ore with an estimated 55,600 ounces of contained gold that, at a 94% recovery rate, amounts to 52,300 ounces of recoverable gold.

- Obtain the amended Doris Permit Amendments.

- Complete and submit the draft environmental impact statement on Madrid and Boston.

- Deploy approximately $23 million of the net proceeds of $56.5 million from the Bought Deal Financing in 2016, with the balance of approximately $33 million to be spent in 2017, for the development of a ramp to access, explore for and delineate potential Mineral Resources and Reserves at the Doris BTD Zone.

Financial and Corporate

- Draw down the remaining funds under the Debt Facility.

THE HOPE BAY PROJECT’S PATH TO PRODUCTION OVERVIEW

With the $9 million of funds raised from the flow-through common share financing on March 18, 2016 (the FT Financing”) the total estimated cash outflows, including working capital, for the combined 2015 and 2016 years for the Path to Production plan increased from $325 million to $334 million. As at September 30, 2016, TMAC had incurred $294 million of the planned $334 million of cash outflows under the Path to Production plan. The cash outflows to date are in line with the Path to Production plan in terms of timing and the amount of cash outflows. The expenditures included in the Path to Production are based on the two calendar years commencing January 1, 2015. Accordingly, by the end of September 2016, TMAC is 21 months into those planned 24 months of expenditures, or 88% of the way, and envisions achieving commercial production of gold during the first quarter of 2017.

At September 30, 2016, TMAC had $92 million of cash and cash equivalents excluding restricted cash of $29 million that is composed of a $10 million minimum cash balance in a segregated account in accordance with the Debt Facility requirements and $19 million invested in guaranteed investment certificates set aside as collateral for the letters of credit (the "Letters of Credit”) that support environmental rehabilitation bonding and provide security for compliance under various agreements with Inuit organizations. The existing cash on hand, together with the US$20 million remaining to be drawn on the Debt Facility, provide an approximate $40 million cushion for the Company to achieve commercial production at the Hope Bay Project, expected in the first quarter of 2017 at Doris. The proceeds from the Bought Deal Financing will be used for exploration and development of the BTD Zone but provide an additional cash cushion if needed.

Table 1 shows the expected cash outflows over the two-year period 2015-2016 detailed in the Path to Production plan and the actual expenditures to date. TMAC has completed approximately 89% of the work.

Table 1: Path to Production cash outflows for the period from January 1, 2015 to December 31, 2016.

| Principal Purpose |

Path to Production |

Incurred to |

||

| $ million | $ million | |||

| Hope Bay Project development costs | ||||

| Direct costs | 145 | 128 | ||

| Indirect costs | 20 | 18 | ||

| Capitalized pre-production operating costs | 54 | 45 | ||

| Hope Bay Project development sub-total | 219 | 191 | ||

| Corporate, exploration, permitting and general expenditures related to the Hope Bay Project | 89(1) | 84 | ||

| Path to Production development sub-total | 308 | 275 | ||

| Collateral for Letters of Credit | 26 | 19 | ||

| Total | 334(2) | 294 |

(1) Includes $9 million from the FT Financing completed March 18,

2016.

(2) Comprises $325 million of the Path to

Production and $9 million from the Flow-Through Financing.

The development of the Doris deposit continues on schedule to produce gold in January 2017 and to achieve commercial production during the first quarter of 2017. The Path to Production development sub-total costs of $275 million to September 30, 2016, originally budgeted at $308 million for the two year period ended December 31, 2016, are forecast to be approximately on budget with some additional costs incurred to complete all of the foundation work on the Mill Building and additional costs for vessels for the 2016 sealift, partially offset by cost reductions in other areas. The net additional costs are currently expected to be less than 2% of the original $308 million budget. In addition, TMAC expects the letters of credit supporting environmental rehabilitation bonding will now be approximately $34 million instead of $26 million. The increase in environmental bonding results from a number of factors essentially not within TMAC’s control (see Environmental Rehabilitation Bonding section in the third quarter 2016 MD&A).

TMAC’s Path to Production plan includes having a high-grade gold ore stockpile on surface at December 31, 2016 that totals 110,700 tonnes with 55,600 ounces of contained gold (at 15.2 g/t) to provide the Processing Plant with significant feed at start-up and a smooth production ramp-up to 1,000 tonnes per day in 2017 and, following the delivery and installation of a second Gekko fabricated ore grinding circuit to site in the 2017 sealift, to 2,000 tonnes per day in early 2018.

Table 3: Path to Production metrics for the pre-production period 2015 – 2016.

|

Three months ended

September 30, 2016 |

Nine months ended

September 30, 2016 |

|||||||||||

| Actual | Plan | Variance | Actual | Plan | Variance | |||||||

| Development: | ||||||||||||

| Tonnes of ore mined | 32,200 | 30,900 | 1,300 | 68,000 | 75,800 | (7,800) | ||||||

| Tonnes of waste mined | 51,600 | 41,500 | 10,100 | 134,400 | 119,800 | 14,600 | ||||||

| Total tonnes mined | 83,800 | 72,400 | 11,400 | 202,400 | 195,600 | 6,800 | ||||||

| Metres | 1,506 | 1,371 | 135 | 3,605 | 3,661 | (56) | ||||||

| Average Au grade g/t | 16.1 | 23.4 | (7.2) | 15.0 | 16.1 | (1.1) | ||||||

| Contained Au ounces | 16,700 | 23,200 | (6,500) | 32,700 | 39,200 | (6,500) | ||||||

| As at September 30, 2016 | ||||||||||||

| Actual | Plan | Variance | ||||||||||

| Estimated Stockpile:(1) | ||||||||||||

| Tonnes | 89,100 | 87,700 | 1,400 | |||||||||

| Average Au grade g/t | 14.7 | 14.5 | 0.2 | |||||||||

| Contained Au ounces | 42,100 | 40,900 | 1,200 | |||||||||

|

(1) Estimated stockpile on surface includes 12,700 tonnes of ore containing an estimated 5,600 ounces of gold (at a 94% recovery rate is 5,300 ounces of recoverable gold) that had been brought to surface prior to underground development commencing in October 2015 (i.e., ore from test mining by TMAC in early 2015 and by Newmont in 2010 prior to TMAC’s acquisition of Hope Bay) and 8,500 tonnes of ore containing an estimated 3,800 ounces of gold mined from October 2015 to December 2015. |

||||||||||||

EXPLORATION AND DEVELOPMENT BELOW THE DYKE AT DORIS

Historical drilling that targeted the BTD Zone had been limited by the few surface drilling platforms available to adequately drill from Doris Mountain north of the Doris camp infrastructure. Underground exploration drilling on the BTD Zone commenced late in the first quarter of 2016 from the underground exploration drift developed during the fourth quarter of 2015 and first quarter of 2016. The exploration drift provided drilling platforms necessary to effectively test high potential targets beneath the diabase dyke. Exploration drilling success on the Doris North BTD Extension and Doris North BTD East Limb gold mineralized zones (the initial results of which were in TMAC’s news release of June 7, 2016) provided the confidence required to initiate underground ramp development below the diabase dyke. A news release summarizing the BTD Zone drilling results to date was issued on September 14, 2016.

Figure 1: Doris North BTD Zone location of the planned access ramp and additional exploration areas accessible for underground diamond drilling.

The spiral ramp used to exploit the known Doris deposit above the diabase dyke will be extended to begin the access ramp to the BTD Zone. The original exploration drift will be repurposed for mining operations. The Doris North BTD ramp development is designed to fulfil three primary objectives:

(1) Provide access to the Doris North BTD East Limb for lateral

development;

(2) Provide proximal drilling platforms to effectively

drill the Doris North BTD Extension; and,

(3) Provide drilling

platforms for additional exploration drilling below the diabase in areas

of high potential.

Figure 1 illustrates the planned ramp development and additional exploration areas to be followed up from the exploration results. Access development commenced in the fourth quarter of 2016 from the bottom of the Doris North spiral haulage ramp and will proceed north towards the Doris North BTD East Limb and Doris North BTD Extension. Further diamond drilling exploration will begin in the first quarter of 2017 as development progresses and drilling platforms become available. Development will reach the Doris North BTD Extension and Doris North BTD East Limb areas in the third quarter of 2017 providing access to the Doris North BTD East Limb and platforms for infill diamond drilling. The Doris North BTD East Limb zone is sufficiently drilled to allow initial resource models to be estimated; however, the more complicated geometry of the Doris North BTD Extension zone will require extensive infill drilling prior to resource modelling.

TMAC raised gross proceeds of $60 million in the Bought Deal Financing that closed in July 2016 to begin this work. The net proceeds of approximately $56.5 million will be used in 2016 and 2017 for the development of a ramp to access the BTD Zone and to explore for additional ounces at the BTD Zone (table 2 below).

Table 2: BTD Zone budgeted exploration and development cash outflows for the period from July 19, 2016 to December 31, 2017.

| Principal Purpose | 2016-2017 | |

| $ million | ||

| Exploration and development of the BTD Zone at Doris | 30.5 | |

|

Equipment and site infrastructure costs related to exploration and |

14.5 | |

| General working capital, including diesel fuel | 11.5 | |

| Total | 56.5 |

TMAC has incurred $21.4 million of expenditures up to September 30, 2016 using proceeds from the Bought Deal Financing. TMAC expects to incur an additional $3 million on BTD Zone development and exploration in the fourth quarter of 2016.

STATEMENT OF PROFIT OR LOSS

Net loss and comprehensive loss for the three and nine months ended September 30, 2016 were $2,799,000 and $5,992,000, respectively, compared with $1,851,000 and $6,500,000, respectively, for the three and nine months ended September 30, 2015.

CASH AND LIQUIDITY

Cash and cash equivalents, exclusive of restricted cash, totaled $91,995,000 as at September 30, 2016 compared with $44,101,000 at December 31, 2015. The increase in cash and cash equivalents resulted from the proceeds from the Debt Facility drawdowns on February 10, July 19 and September 26, 2016, the FT Financing and Bought Deal Financing and the proceeds received from the exercise of Warrants, partially offset by expenses incurred to advance the development of Hope Bay.

ADDITIONAL MATERIAL

We encourage our readers to review TMAC’s third quarter 2016 MD&A as well as it contains a number of photos of the site construction, as well as figures relating to our exploration activities.

ABOUT TMAC

TMAC holds a 100% interest in the Hope Bay Project located in Nunavut, Canada. TMAC is a fully financed, gold development company on target to achieve its Path to Production plan, beginning with the Doris Deposit, by the end of 2016. The Company has a board of directors with depth of experience and market credibility and an exploration and development team with an extensive track record of developing high grade, profitable underground mines.

FORWARD-LOOKING INFORMATION

This release contains "forward-looking statements” or "forward-looking information” within the meaning of applicable securities laws that are intended to be covered by the safe harbours created by those laws. "Forward-looking information” includes statements that use forward-looking terminology such as "may”, "will”, "expect”, "anticipate”, "believe”, "continue”, "potential” or the negative thereof or other variations thereof or comparable terminology. Such forward-looking information includes, without limitation, bringing the Hope Bay Project into production, beginning with the timing of the construction of the Processing Plant, the commissioning of the Processing Plant at Doris by the end of 2016, the availability of funds under the Debt Facility, and that the cash on hand and drawdowns under the Debt Facility will be sufficient to fully fund the Hope Bay Project and the objectives of the exploration program.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management, in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date the statements are made including, without limitation, assumptions about: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the development of the Hope Bay Project and pursue planned exploration; future prices of gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Hope Bay Project being as described in the prefeasibility study entitled "Technical Report on the Hope Bay Project, Nunavut, Canada”, dated May 28, 2016 (effective date of March 31, 2015); the metallurgical characteristics of the Hope Bay Project being suitable for the Processing Plant; the stockpile at the end of 2016 having the characteristics projected in the Path the Production Plan, the successful installation and operation of the Processing Plant; the successful completion of the tailings impoundment area, production costs; the accuracy of budgeted exploration and development costs and expenditures, including to complete development of the infrastructure at the Hope Bay Project; the price of other commodities such as diesel fuel; future currency exchange rates and interest rates; operating conditions being favourable, including whereby the Company is able to operate in a safe, efficient and effective manner; political and regulatory stability; the receipt of governmental and third party approvals, licences and permits on favourable terms; obtaining required renewals for existing approvals, licences, permits and Inuit agreements and obtaining all other required approvals, licences, permits and Inuit agreements on favourable terms; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with the Kitikmeot Inuit Association, NIRB, NWB, and Nunavut Tunngavik Inc. and other local groups and the Company’s ability to meet its obligations under its property agreements with such groups; the Company’s ability to operate in the harsh northern Canadian climate; and satisfying the terms and conditions of the Debt Facility. While the Company considers these assumptions to be reasonable, the assumptions are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking information. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

The Company cautions that the foregoing lists of important assumptions and factors are not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking information contained herein. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, investors should not place undue reliance on forward-looking information.

SOURCE TMAC Resources Inc.

CONDENSED STATEMENT OF FINANCIAL POSITION

(Unaudited)

(Expressed

in Canadian dollars)

|

As at |

As at

December 31, 2015 |

|||

| $000s | $000s | |||

| Assets | ||||

| Current assets | ||||

| Cash and cash equivalents | 91,995 | 44,101 | ||

| Amounts receivable | 5,193 | 3,996 | ||

| Consumables, materials and supplies | 56,878 | 26,486 | ||

| Prepaid expenses | 935 | 2,152 | ||

| Equipment held for sale | 500 | 500 | ||

| 155,501 | 77,235 | |||

| Non-current assets | ||||

| Property, plant and equipment | 784,950 | 649,443 | ||

| Goodwill | 80,600 | 80,600 | ||

| Restricted cash | 29,141 | 18,656 | ||

| Other assets | 9,109 | 28,497 | ||

| 903,800 | 777,196 | |||

| Total assets | 1,059,301 | 854,431 | ||

| Liabilities | ||||

| Current liabilities | ||||

| Accounts payable and accrued liabilities | 22,912 | 12,735 | ||

| Debt Facility | 18,933 | - | ||

| Gold Call Options | 4,938 | - | ||

| Other liabilities | 911 | - | ||

| 47,694 | 12,735 | |||

| Non-current liabilities | ||||

| Debt Facility | 109,992 | - | ||

| Gold Call Options | - | 2,731 | ||

| Provision for environmental rehabilitation | 24,719 | 24,719 | ||

| Deferred tax liabilities | 69,868 | 71,440 | ||

| 204,579 | 98,890 | |||

| Total liabilities | 252,273 | 111,625 | ||

| Equity | ||||

| Share capital | 824,771 | 755,896 | ||

| Warrants | 2,139 | 2,936 | ||

| Contributed surplus | 8,125 | 5,989 | ||

| Accumulated deficit | (28,007) | (22,015) | ||

| 807,028 | 742,806 | |||

| Total equity and liabilities | 1,059,301 | 854,431 |

CONDENSED STATEMENT OF PROFIT OR LOSS

(Unaudited)

(Expressed

in Canadian dollars)

|

Three |

Three |

Nine |

Nine |

|||||

| $000s | $000s | $000s | $000s | |||||

| General and administrative | ||||||||

| Salaries and wages | 1,553 | 855 | 4,455 | 2,149 | ||||

| Share-based payments | 717 | 489 | 2,079 | 2,014 | ||||

| Professional and consulting fees | 32 | 316 | 336 | 700 | ||||

| Travel | 77 | 38 | 252 | 156 | ||||

| Investor relations | 75 | 51 | 368 | 106 | ||||

| Depreciation | 11 | 4 | 19 | 12 | ||||

| Office, regulatory and general | 408 | 187 | 904 | 415 | ||||

| Loss before the following | 2,873 | 1,940 | 8,413 | 5,552 | ||||

| Finance income | (259) | (181) | (556) | (411) | ||||

| Finance expense | 161 | 526 | 518 | 1,540 | ||||

| Business development expenses | - | 139 | - | 850 | ||||

| Foreign exchange loss (gain) | 701 | (637) | (2,612) | (764) | ||||

| Fair value loss (gain) | (104) | 262 | 2,207 | 262 | ||||

| Other | 33 | 335 | 94 | 510 | ||||

| Loss before income taxes for the period | 3,405 | 2,384 | 8,064 | 7,539 | ||||

| Deferred income tax expense (recovery) | (606) | (533) | (2,072) | (1,039) | ||||

| Net loss and comprehensive loss for the period | 2,799 | 1,851 | 5,992 | 6,500 | ||||

| Net loss per share | ||||||||

| Basic & diluted | ($0.03) | ($0.02) | ($0.08) | ($0.11) | ||||

| Weighted average number of shares (thousands) | ||||||||

| Basic and diluted | 82,206 | 74,835 | 79,516 | 58,656 |

|

CONDENSED STATEMENT OF CASH FLOWS

(Unaudited) (Expressed in Canadian dollars) |

Three |

Three |

Nine |

Nine |

||||

| $000s | $000s | $000s | $000s | |||||

| Net loss for the period | (2,799) | (1,851) | (5,992) | (6,500) | ||||

|

Operating activities |

||||||||

| Adjusted for: | ||||||||

| Share-based payments | 717 | 489 | 2,079 | 2,014 | ||||

| Finance income | (259) | (181) | (556) | (411) | ||||

| Finance expense | 161 | 526 | 518 | 1,540 | ||||

| Depreciation | 11 | 4 | 19 | 12 | ||||

| Unrealized foreign exchange loss (gain) | 701 | 139 | (2,612) | - | ||||

| Fair value loss (gain) | (104) | 262 | 2,207 | 262 | ||||

| Deferred income tax expense (recovery) | (606) | (533) | (2,072) | (1,039) | ||||

| Other | - | 238 | - | 238 | ||||

| Increase (decrease) in non-cash operating working capital: | ||||||||

| Amounts receivable | (2,831) | (1,382) | (1,237) | (1,704) | ||||

| Inventory | (38,761) | - | (38,761) | - | ||||

| Prepaid expenses | 7,064 | 1,308 | (129) | 48 | ||||

| Accounts payable and accrued liabilities | - | (235) | - | 557 | ||||

| Operating cash flows before interest and tax | (36,706) | (1,216) | (46,536) | (4,983) | ||||

| Cash tax paid | - | - | - | - | ||||

| Cash interest paid | (19) | (377) | (37) | (1,131) | ||||

| Cash flows from (used in) operating activities | (36,725) | (1,593) | (46,573) | (6,114) | ||||

| Investing activities | ||||||||

| Additions to property, plant and equipment | (30,607) | (63,513) | (98,300) | (107,622) | ||||

| Interest received | 190 | 136 | 469 | 366 | ||||

| Long-term cash deposit | - | (18,006) | - | (18,006) | ||||

| Restricted cash | - | - | (10,485) | (650) | ||||

| Cash flows from (used in) investing activities | (30,417) | (81,383) | (108,316) | (125,912) | ||||

|

Financing activities |

||||||||

| Third Equity Financing, net of issue costs | - | - | - | 40,282 | ||||

| Initial Public Offering | - | 146,839 | - | 146,839 | ||||

| Debt Facility drawdowns | 65,337 | (2,577) | 134,857 | (2,577) | ||||

| Flow-through financing, net of issue costs | - | - | 8,904 | - | ||||

| Warrants exercised | - | - | 3,872 | - | ||||

| Bought Deal Financing, net of issue costs | 56,522 | - | 56,522 | - | ||||

| Cash flows from (used in) financing activities | 121,859 | 144,262 | 204,155 | 184,544 | ||||

| Effects of exchange rate changes on cash and cash equivalents | 61 | 291 | (1,372) | 429 | ||||

| Net increase in cash and cash equivalents for the period | 54,778 | 61,577 | 47,894 | 52,947 | ||||

| Cash and cash equivalents at the beginning of the period | 37,217 | 23,414 | 44,101 | 32,044 | ||||

| Cash and cash equivalents at the end of the period | 91,995 | 84,991 | 91,995 | 84,991 |

View source version on businesswire.com: http://www.businesswire.com/news/home/20161103006887/en/

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu TMAC Resources Incmehr Nachrichten

| Keine Nachrichten verfügbar. |