|

26.04.2017 23:15:00

|

Goldcorp Provides First Quarter 2017 Exploration Update

VANCOUVER, April 26, 2017 /PRNewswire/ - GOLDCORP INC. (TSX: G, NYSE: GG) is pleased to provide an update on its 2017 exploration program. Representative drill results are provided below; website links to further information including full drill results, drill coordinates, QA/QC information and relevant diagrams are provided at the end of each section.

Highlights

- Drilling at Cerro Negro returned positive results. Further encouraging results have been returned from Silica Cap and the Bajo Negro hanging wall, supporting continued drilling on these two targets. Results include: 20.80g/t Au over 5.01m (Bajo Negro hanging wall, BDD-17006) and 4.75g/t Au over 5.16m (Silica Cap, SCDD-17003).

- Drilling at the Coffee project commenced. The field season commenced in March and a total of 7,317m of reverse circulation drilling was completed at Supremo T8-T9 and Arabica during the month.

- Generative study work at Peñasquito yielded 13 new targets for follow-up testing. The initial study work covered a 50km by 30km block centered over the Peñasquito and Concepción del Oro districts; the targets will be assessed for geological and economic potential.

- Continued exploration progress in the Timmins Camp. Additional targets have been identified and as part of the pre-feasibility study at the Century Project, drilling has commenced with the aim of converting mineral resources to mineral reserves through tighter drill spacing.

"During the quarter we continued to focus our efforts on reserve replacement and populating the resource triangle with new targets," said Paul Harbidge, Senior Vice-President, Exploration. "I am encouraged with the positive results that we are seeing from our portfolio of projects as well as the generative studies which are laying the foundation for future exploration success. We are well positioned to meet our targeted 20% increase in reserves over the next five years."

CANADA

Coffee Project

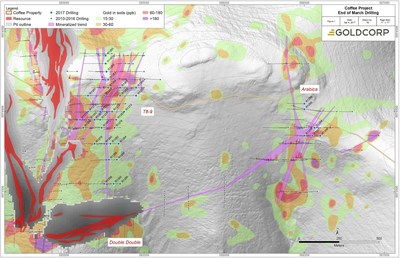

The 2017 field season commenced in March with two reverse circulation ("RC") drill rigs infill drilling on the advanced targets of Supremo T8-9 and Arabica, which are located 0.2 and 1.5km east of the planned Supremo open pit (Figure 1). By the end of the first quarter, a total of 7,317m of RC drilling had been completed.

Coffee – Exploration Drilling at Supremo

Supremo T8-T9

At Supremo T8-T9, the gold assay results from 17 holes were received by the end of the first quarter of 2017, intercepts include 1.88g/t Au over 10.66m from 51.82m (CFR1276) and 1.38g/t Au over 15.24m from 59.44m (CFR1278). Field X-ray fluorescence analysis and logging of drill chips has mapped out up to five north to northeasterly trending deformation and alteration zones spaced 30m-100m apart, with strike lengths of 200m-1000m within an overall gold geochemical footprint of 1500m by 400m. The host lithology comprises gently south dipping quartz-feldspar augen gneiss with localized lenses of biotite schist. The deformation zones comprise steeply dipping breccia/fracture zones which have a pinch and swell morphology and commonly splay and bifurcate.

The table below presents the drill assay results received during the first quarter of 2017 from Supremo T8-T9. Full drill coordinates are available at the following:

Hole_ID | Depth (m) | From (m) | To (m) | Intercept (m) | Au (g/t) |

CFR1262 | 201 | 38.10 | 41.15 | 3.05 | 1.30 |

CFR1263 | 201 | 25.91 | 28.96 | 3.05 | 1.70 |

and | 47.24 | 48.77 | 1.53 | 3.70 | |

CFR1264 | 201 | 30.48 | 35.05 | 4.57 | 3.05 |

and | 80.77 | 82.30 | 1.53 | 1.12 | |

and | 111.25 | 112.78 | 1.53 | 1.12 | |

CFR1265 | 201 | 59.44 | 60.96 | 1.52 | 1.97 |

and | 172.21 | 182.88 | 10.67 | 1.06 | |

CFR1266 | 201 | 76.20 | 79.25 | 3.05 | 0.90 |

and | 121.92 | 126.49 | 4.57 | 1.34 | |

and | 170.69 | 172.21 | 1.52 | 1.06 | |

CFR1267 | 201 | 85.34 | 86.87 | 1.53 | 1.40 |

and | 100.58 | 103.63 | 3.05 | 0.75 | |

and | 117.35 | 118.87 | 1.52 | 1.01 | |

CFR1268 | 201 | 149.35 | 153.92 | 4.57 | 1.54 |

CFR1269 | 201 | 70.10 | 73.15 | 3.05 | 1.11 |

CFR1270 | 201 | 129.54 | 131.06 | 1.52 | 1.44 |

CFR1271 | 201 | 108.20 | 112.78 | 4.58 | 2.03 |

CFR1272 | 201 | 118.87 | 120.40 | 1.53 | 1.08 |

CFR1273 | 201 | 85.34 | 86.87 | 1.53 | 2.39 |

and | 96.01 | 100.58 | 4.57 | 1.40 | |

and | 105.16 | 108.20 | 3.04 | 1.75 | |

and | 150.88 | 153.92 | 3.04 | 0.82 | |

CFR1274 | 201 | 144.78 | 152.40 | 7.62 | 1.46 |

CFR1275 | 201 | 7.62 | 9.14 | 1.52 | 1.64 |

and | 24.38 | 25.91 | 1.53 | 1.88 | |

and | 33.53 | 35.05 | 1.52 | 1.25 | |

and | 135.64 | 144.78 | 9.14 | 1.77 | |

and | 172.21 | 175.26 | 3.05 | 1.59 | |

CFR1276 | 201 | 39.62 | 41.15 | 1.53 | 2.99 |

and | 51.82 | 62.48 | 10.66 | 1.88 | |

and | 79.25 | 82.30 | 3.05 | 2.23 | |

and | 143.26 | 146.30 | 3.04 | 2.02 | |

CFR1277 | 158 | No significant result | |||

CFR1278 | 201 | 59.44 | 74.68 | 15.24 | 1.38 |

Arabica

At Arabica, all gold assay results are pending. Drilling tested a gold-in-soil geochemical footprint of 1200m x 750m, and up to three individual structures trending north to north-easterly.

Drilling is currently underway on a 25m x 25m infill program of the existing Latte indicated resource with the aim of converting the majority of the inferred resources contained within the planned Latte pit to a measured category.

Planning of additional exploration programs is ongoing across a range of targets within the Coffee property. Diamond core drilling, geochemical and geophysical surveys and scout drilling programs are also expected to resume in the second quarter.

Red Lake Camp

Exploration activity in Red Lake concentrated on three main project areas: Campbell-Red Lake, HG Young, and Cochenour.

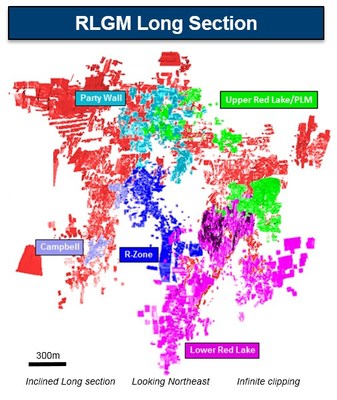

Campbell - Red Lake exploration targeted five main areas of the deposit in the first quarter of 2017: R zone / Lower 56, Upper Red Lake (URL), Party Wall, Campbell and Lower Red Lake. A combined 31,311m of underground drilling were completed for potential resource conversion, as well as resource addition. Figure 2 is a generalized long section showing the locations of the target areas.

Representative results above the cutoff grade from Campbell-Red Lake Mine exploration, received during the first quarter of 2017, are shown in the table below. Full drill results and drill coordinates are available at the following:

Red Lake – Drill Results; Drill Coordinates

Hole_ID | Zone | Including | From (m) | To (m) | Intercept (m) | True Width (m) | Au g/t |

41L900 | 56 Zone | 146.85 | 147.04 | 0.19 | 0.18 | 193.84 | |

41L904 | 56 Zone | 243.54 | 244.45 | 0.91 | 0.81 | 35.64 | |

41L905 | 56 Zone | 245.67 | 246.28 | 0.61 | 0.55 | 168.82 | |

41L908 | 56 Zone | 256.34 | 256.95 | 0.61 | 0.56 | 54.60 | |

41L929 | 56 Zone | 120.00 | 123.44 | 3.44 | 3.33 | 8.76 | |

41L929 | 56 Zone | Including | 122.90 | 123.44 | 0.54 | 0.53 | 51.97 |

D211951 | 56 Zone | 117.32 | 119.27 | 1.95 | 1.60 | 26.65 | |

41L906 | 56 Zone | 256.95 | 257.25 | 0.30 | 0.26 | 130.29 | |

D211928 | A/SC Zone | 86.93 | 87.63 | 0.70 | 0.64 | 103.67 | |

46L317 | DS | 219.15 | 219.52 | 0.37 | 0.33 | 76.51 | |

46L317 | DS | 298.28 | 299.92 | 1.64 | 1.49 | 28.14 | |

46L317 | DS | 219.15 | 219.52 | 0.37 | 0.33 | 76.51 | |

46L317 | DS | 298.28 | 299.92 | 1.64 | 1.49 | 28.14 | |

46L318 | DS | 286.69 | 295.35 | 8.66 | 7.50 | 3.04 | |

D13902 | MC zone | 177.40 | 179.80 | 2.40 | 2.03 | 9.94 | |

D211946 | NL Zone | 0.00 | 0.34 | 0.34 | 0.30 | 298.36 | |

D211948 | NL Zone | 21.34 | 22.71 | 1.37 | 1.26 | 13.75 | |

D211948 | NL Zone | including | 21.67 | 21.98 | 0.31 | 0.28 | 57.55 |

41L925 | R Zone | 80.01 | 80.50 | 0.49 | 0.42 | 36.12 | |

41L894 | R Zone | 95.10 | 98.27 | 3.17 | 2.50 | 102.01 | |

41L894 | R Zone | Including | 95.10 | 95.55 | 0.45 | 0.14 | 161.49 |

41L894 | R Zone | Including | 96.04 | 96.19 | 0.15 | 0.12 | 1,866.50 |

41L931 | R Zone | 157.58 | 157.89 | 0.31 | 0.26 | 67.46 | |

17L1547 | RL- J Zone | 51.54 | 53.49 | 1.95 | 1.65 | 17.66 | |

17L1547 | RL- J Zone | including | 52.09 | 52.36 | 0.27 | 0.23 | 101.63 |

17L1550 | RL- J Zone | 34.59 | 35.17 | 0.58 | 0.53 | 42.39 | |

17L1555 | RL- J Zone | 78.94 | 79.80 | 0.86 | 0.70 | 33.78 | |

17L1559 | RL- J Zone | 28.22 | 33.53 | 5.31 | 4.59 | 4.47 | |

D13898 | RL-F Zone | 94.20 | 97.80 | 3.60 | 3.26 | 10.17 | |

D13898 | RL-F Zone | including | 96.40 | 96.60 | 0.20 | 0.16 | 60.34 |

D13898 | RL-F Zone | including | 96.90 | 97.50 | 0.60 | 0.54 | 30.00 |

D13898 | RL-F Zone | including | 100.30 | 100.70 | 0.40 | 0.30 | 6.17 |

D13898 | RL-F Zone | 157.30 | 158.20 | 0.90 | 0.79 | 95.31 | |

41L932 | R-Zone | 153.62 | 154.53 | 0.91 | 0.83 | 45.60 |

In the second quarter, work will be focused on the development of geological models with the aim to support the mid-year reserve and resource estimations.

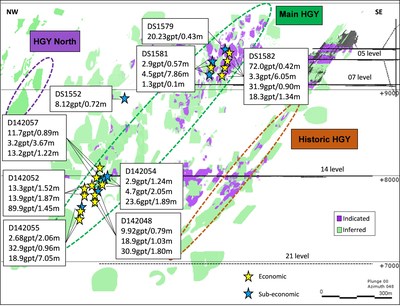

HG Young – Work in the first quarter concentrated on building a solid understanding of the geological and structural controls on mineralization. New oriented core drilling is being used to supplement the core re-logging program. Over 12,100m has been re-logged to date with approximately 1,500m remaining and will be completed by mid-April 2017. Underground oriented core drilling began in February from 14L to examine the structural controls of the higher grade mineralization between 13L to 15L. By the end of the first quarter of 2017 five holes had been drilled totaling 1,633m.

Although no surface drilling was completed during the first quarter of 2017, results were returned from surface drilling completed at the end of 2016. These holes focused on the upper extents of HG Young from 3-6L and intersected the distinctive high-grade quartz-scheelite HG Young style veins that are characteristic of this deposit. Representative results from surface and underground drilling are summarized in Figure 3.

Representative results from HG Young are shown in the table below. Full drill results and drill coordinates are available at the following:

HG Young – Drill Results; Drill Coordinates

Hole_ID | Zone | From (m) | To (m) | Intercept (m) | True Width (m) | Au g/t |

D142048 | 16L | 208.50 | 209.80 | 1.30 | 1.03 | 18.96 |

D142048 | 16L | 251.50 | 253.50 | 2.10 | 1.80 | 30.88 |

D142052 | 14L | 120.10 | 121.60 | 1.50 | 1.52 | 13.26 |

D142052 | 15L | 209.10 | 210.90 | 1.80 | 1.45 | 17.67 |

D142052 | 15L | 255.60 | 257.30 | 1.80 | 1.45 | 89.90 |

D142054 | 15L | 262.90 | 265.20 | 2.30 | 1.89 | 26.64 |

D142055 | 17L | 208.00 | 209.10 | 1.10 | 0.96 | 32.94 |

D142055 | 17L | 221.10 | 229.20 | 8.10 | 7.05 | 18.92 |

D142057 | 14L | 86.60 | 87.80 | 1.20 | 0.89 | 11.74 |

D142057 | 14L | 123.40 | 127.50 | 4.10 | 3.67 | 3.18 |

D142057 | 14L | 217.00 | 218.30 | 1.30 | 1.22 | 13.24 |

The updated geological model reveals that mineralization at HG Young is controlled by a major shear which strikes 135o -145o within which the mineralized veins are orientated with a strike direction of 165o. There is a well-defined plunge at the intersection of the veining and the shear, within a range 20o -26o (dip) towards 306o -322o.

Late brittle low angle faults trending north-northeast (dipping east) have been recognized and preliminary findings suggest that they potentially play a major role in offsetting both stratigraphy and ore-bearing structures. The amount of lateral and vertical displacement of these structures is currently unknown, although detailed structural analysis is ongoing.

In the second quarter, underground drilling will continue from 14L to test the up-and down-plunge extension of the mineralization as well as surface drilling to infill resource blocks at shallower levels (above 7L). This work, together with the re-logging, will lead to a revised geological model to support an updated block model as part of the mid-year reserve and resource estimations.

Cochenour – During the first quarter, work continued on developing the geologic understanding of the Upper Main Zone (UMZ1), in the starter mine area. An oriented core drilling and re-logging program (116 holes) was completed and covered levels 3710-4270. This work will culminate in a new geological model and updated block model to support the starter mine concept.

During the first quarter all assay results from the oriented drilling program completed in December 2016 were returned. Representative drill intercepts are shown in the table below. Full drill results and drill coordinates are available at the following:

Cochenour – Drill Results; Drill Coordinates

Hole ID | Level | Zone | From (m) | To (m) | True Width (m) | Au g/t |

C39609 | 3850L | UMZ | 181.40 | 187.70 | 4.53 | 8.65 |

C39676 | 3780L | Footwall | 239.90 | 244.80 | 4.11 | 11.23 |

C39679 | 4200L | UMZ | 109.30 | 123.70 | 13.72 | 10.24 |

C39678 | 3850L | UMZ | 134.70 | 152.70 | 14.94 | 5.39 |

C39680 | 3780L | UMZ | 169.20 | 172.80 | 3.05 | 33.04 |

C39681 | 4200L | UMZ | 114.00 | 126.80 | 11.61 | 8.41 |

C39677 | 4200L | UMZ | 122.90 | 134.60 | 11.49 | 5.93 |

C39682 | 4200L | UMZ | 123.00 | 131.40 | 6.83 | 6.47 |

Musselwhite

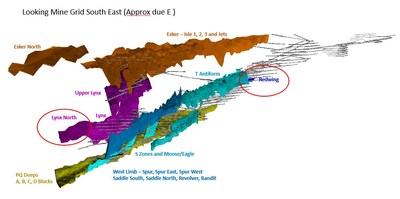

During the first quarter, exploration at Musselwhite was focused on potential resource conversion and zone expansion in the PQ Deeps and West Limb areas of the mine, as well as testing several underground exploration targets (Figure 4).

PQ Deeps drilling further stepped out down plunge on the next 25m section (14075N). Positive results for the lower section of PQ Deeps C Block were returned from holes drilled late in the fourth quarter of 2016 as well as new holes from the first quarter of 2017 and confirmed mineralization is open down plunge, most notably for the lower section.

Musselwhite – 3D Model of Ore Zones

Musselwhite – Drill Results; Drill Coordinates

Twenty-one infill and step out holes were drilled underground on the West Limb (WEL) to refine the geological model and extend conversion strike length to 800m. Refinement of the model led to splitting the Saddle zone into two zones, creating a new lower mineralized area named the Hackamore (Hack) zone. Results from the West Limb drilling returned favourable results in the northern extensions of the Saddle and Revolver (17-WEL-004 7.3m @ 5.01g/t Revolver, 17-WEL-005 10.6m @ 6.23g/t Saddle) and confirmed the grade continuity within the Spur zones. Where possible, drill holes were extended further into the footwall to test the Bandit zone, which continues to return mineralized intersections over much of the known strike length of the West Limb. The first development cross cut from 720 WEL access drift through the West Limb mineralization has intersected the Spur, Spur West and Hackamore zones at section 12800N. Zone geometry and grades are as expected in all areas. The second cross cut from 720 has started, and is planned to intersect the Saddle, Hackamore and Revolver at section 13100N by the end of the second quarter of 2017 (a 300m down plunge advancement).

The winter surface drill program that began in late 2016, testing the up plunge continuity of West Limb structures, was cut short due to unexpected early thaw conditions. The program completed four drill holes on one section (11350), approximately 200m to the south of known mineralization. Results were favourable, indicating changes in both structure and mineralization style moving up plunge. Refinement of the geological model and structural interpretation for this area will take place over the summer months, with follow up targets planned aiming at an open pit mining scenario to be planned and tested at freeze up in late 2017 or early 2018.

Redwing underground exploration drilling started in the first quarter. The Redwing target is a previously known area of mineralization hosted within a 100m scale Z-fold in the Southern Iron Formation (SIF). Exploration drilling to determine the extent of the SIF structure, and metallurgical testing of the mineralized zones will continue as the year progresses.

Lynx North underground exploration drilling also began during the first quarter of 2017, following up on the 2015-2016 drill results that indicated a mineralized horizon 300m north of the known end of the main Lynx Zone. One section was completed during the first quarter of 2017, with assays confirming the presence of mineralization in this position. The current known strike length is 400m with an average dip extent of 100m.

Mine scale exploration in the second quarter of 2017 will see the Lynx North rig deployed to drill one more section in the PQ Deeps C Block with the aim of further extending the current reserve on the orebody. West Limb resource conversion and Redwing drilling will continue with the current drill programs. A surface helicopter-supported drill program on the north shore of Opapamiskin Lake will mobilize at the end of the second quarter of 2017. This is a deep drilling and wedging program designed to test the northern extent of Musselwhite mineralization in the eastern PQ limb with a 1km step out from the last known mineralized drill intersection.

Porcupine Camp

The Porcupine district exploration group is exploring in several project areas including the Century Project, Hoyle Pond and known advanced prospects within the Timmins camp, as well as the Borden Project in Chapleau. In addition, a district scale prospectivity analysis commenced during the first quarter.

The Century Project advanced to the pre-feasibility stage during the first quarter of 2017. As part of this study, a drilling program began in late March with two major objectives: 1) a geotechnical program to provide critical information for the mine design, and 2) an infill program with an aim to convert mineral resources to mineral reserves in 2017-2018. The geotechnical program consists of nine holes for a total of 4,900m. By the end of the first quarter of 2017 two geotechnical holes were completed, for a total 877m. Results from assays are pending. The infill program is planned to begin in the second quarter of 2017. The program consists of 21,000m to be drilled from existing underground workings targeting six different areas.

In parallel, 36,000m of infill drilling will be carried out from surface. The surface infill program is planned to begin subsequent to the geotechnical program. Both the underground and surface programs will be drilled in phased sequence to allow tighter spaced drilling based on first pass results.

Drilling at Hoyle Pond continued, with the completion of 8,441m during the first quarter of 2017, to evaluate the down plunge extension of the S, XMS and UM3 vein systems as well as the east mafics zone, with the aim of replacing reserves. Gold assay results confirmed the continuity of mineralization and the veins remain open down plunge.

Representative results from Porcupine East Mafics, UM3, XMS and S Veins are shown in the table below. Full drill results and drill coordinates are available at the following:

Porcupine – Drill Results; Drill Coordinates

Hole_ID | Mine Level | Target | From (m) | To (m) | Width (m) | True Width (m) | Au (g/t) |

22751 | 1680 | East Mafics | 430.50 | 430.90 | 0.40 | 0.30 | 18.20 |

22751 | 1680 | East Mafics | 473.50 | 473.80 | 0.30 | 0.10 | 18.90 |

22748 | 1200 | UM3 | 228.30 | 228.60 | 0.30 | 0.30 | 6.50 |

22753 | 1200 | UM3 | 214.40 | 215.00 | 0.60 | 0.50 | 423.00 |

22657 | 1330 | XMS | 336.40 | 336.70 | 0.30 | 0.30 | 24.70 |

22680 | 1680 | S1 | 197.60 | 199.00 | 1.40 | 1.00 | 4.40 |

22682 | 1680 | S1NW | 259.30 | 261.00 | 1.70 | 0.70 | 31.50 |

22683 | 1680 | S1 | 303.80 | 309.10 | 5.30 | 2.70 | 23.70 |

22686 | 1680 | S1 | 305.70 | 307.10 | 1.40 | 1.30 | 51.60 |

At Owl Creek a full geological review was completed following receipt of all assay results from the 2016 drill program. It was concluded that there was limited potential and the target has been removed from the resource triangle.

At Coniaurum gold assay results have been received for the 2,376m drilled in 2016, although no significant assays were received, quartz-tourmaline veining was intersected which was visually encouraging and pyrite enriched, although carbonate alteration was composed of calcite rather than ankerite which is typically coincident with gold mineralization in the Timmins District. No porphyry was identified in these holes, the presence of porphyry being considered integral to major deposits in the Timmins camp, such as MacIntyre. Further work is required on the Hollinger-Macintyre strain corridor to identify any untested gaps.

The Ethier target is the next in line for testing and has a similar geological and structural setting to Hoyle Pond which is located 4km to the east. Most notable similarities are the interpreted subparallel structural trends related to flexures of the Porcupine sediment contact which also transect the same series of the Hersey Lake volcanic package. Ethier is a high grade quartz vein underground target; in addition there are secondary targets in the sediments to the south, possibly refractory in nature. Work is underway to define the minimum exploration work required to advance this early stage conceptual target, including a review of geophysical data which was used in the creation of the current lithological interpretation.

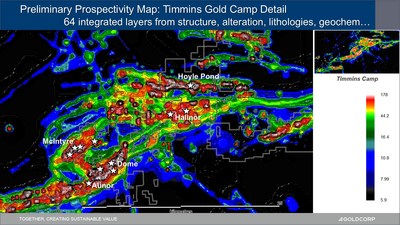

Timmins – Prospectivity Analysis

Good progress was made with a regional Geographical Information Systems compilation across the Timmins camp in the first quarter, with the integration of 64 datasets. This work has already resulted in some interesting preliminary results (Figure 5): 1) all major gold mines in the camp have a strong association with porphyry intrusions, 2) close spatial association between Fe-carbonate alteration and upper greenschist metamorphic anomalies, 3) 060o-075o favourable orientation for structures, and 4) porphyry intrusions may act as structural buttresses allowing focussed fluid flow into a low pressure regime within a sinistral releasing bend.

Borden– In the first quarter, the exploration focus was primarily to initiate the planned review of the Borden geological model. The review is centered on an extensive core re-logging program that will also benefit significantly from a number of planned oriented wedge core holes being drilled through the deposit.

A distinctive mottle-textured amphibolite has been identified at the base of the high grade zone (the Footwall Amphibolite) and can be traced through the deposit and therefore acts as a very good marker horizon. Core re-logging, as well as ongoing orientated drilling, is highlighting two dominant mineralization trends in the deposit, one trend appears to follow the F1 fold axis lineations, and the other is closer to boudin long-axis lineations.

Drilling at Borden West is targeting the Footwall Amphibolite contact and associated gold zone along strike from the Borden deposit. Mineralization is expected to be associated with a garnet biotite felsic gneiss unit, with various amounts of quartz veining/flooding and sulphides. One result was received for hole BL16-1006 but only intersected anomalous gold values. A second hole BL16-01011 remains to be completed.

Final results were returned during the first quarter for the north shore drilling completed in late 2016 to test potential extensions to high grade mineralization. While the stratigraphic rock package was intersected only low grade mineralization over a narrow width was obtained. Two additional wedge holes were completed during the first quarter; gold assay results are pending but core observations revealed weak mineralization. Once results have been received a full analysis will determine whether further drilling is warranted.

Representative results from Borden are shown below in the table. Full drill results and drill coordinates are available at the following:

Borden – Drill Results; Drill Coordinates

Hole_ID | Area | From (m) | To (m) | Width (m) | True width (m) | Au g/t |

BL16-01006 | Borden West | 107.00 | 108.00 | 1.00 | 1.00 | 0.41 |

198.00 | 200.00 | 2.00 | 2.00 | 0.15 | ||

BL16-01001 | HGZ Deep | 1019.10 | 1024.20 | 5.15 | 5.05 | 2.26 |

1034.40 | 1038.30 | 3.94 | 3.80 | 2.67 | ||

BL16-01003 | HGZ Deep | 1142.70 | 1144.80 | 2.10 | 2.10 | 1.24 |

1148.70 | 1150.40 | 1.70 | 1.70 | 1.16 | ||

1165.00 | 1165.70 | 0.70 | 0.70 | 1.67 |

In terms of regional exploration, the results and analysis of a glacial till program completed in 2016 are still pending. Full results and the planned summer exploration program will be presented with the second quarter update.

Éléonore

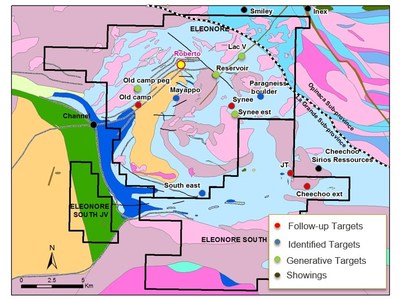

During the first quarter, exploration at Éléonore was carried out on underground mine exploration targets as well as a new surface drill program testing two early stage targets. The surface exploration drilling program started in January 2017 and is the first drilling program outside of the Roberto Zone since 2005. Two target areas were drilled 1) the Old Camp prospect on the west side of the property, and 2) the Synee target located near the eastern boundary of the property (Figure 6). Due to an early spring thaw, drilling was stopped prior to completing all planned holes at Synee.

Éléonore – Target Location Map

The first quarter mine exploration drill program comprised:

- Completion of infill drilling in the upper mine North Block of the 494 area;

- Completion of infill drilling of the south-south ore shoot (upper mine) from level 200;

- Completion of extended holes to follow-up new mineralized zones behind the 494 area; and

- Ongoing lower mine infill program on the central main ore shoot and north 494 area.

Representative results from Éléonore are shown in the table below. Full drill results and drill coordinates are available at the following:

Éléonore – Drill Results; Drill Coordinates

Hole-ID | Zone | From (m) | To (m) | Width (m) | True | Vertical | Au g/t |

EST-16-01321 | Uncorrelated | 732.20 | 735.30 | 3.10 | 2.68 | 1134.05 | 4.44 |

EST-16-01321 | Uncorrelated | 931.00 | 934.00 | 3.00 | 2.60 | 1249.23 | 12.22 |

EST-16-01334 | Uncorrelated | 848.50 | 852.00 | 3.50 | 3.17 | 1169.38 | 20.51 |

EST-16-01357 | Uncorrelated | 956.00 | 961.00 | 5.00 | 3.20 | 1192.90 | 3.18 |

EST-16-01357 | Uncorrelated | 1079.00 | 1084.00 | 5.00 | 2.90 | 1241.93 | 17.20 |

EST-16-01360 | 7000 | 307.05 | 310.05 | 3.00 | 2.90 | 268.32 | 2.68 |

EST-16-01360 | 6000 | 313.05 | 321.40 | 8.35 | 8.20 | 270.07 | 3.89 |

EST-16-01360 | 5050 | 351.85 | 356.00 | 4.15 | 2.70 | 277.40 | 1.09 |

EST-16-01361 | 6000 | 224.40 | 228.50 | 4.10 | 2.70 | 502.03 | 21.60 |

EST-16-01361 | 5050 | 300.50 | 307.10 | 6.60 | 2.80 | 502.03 | 1.38 |

EST-16-01361 | 5010 | 342.50 | 345.50 | 3.00 | 2.70 | 514.43 | 7.94 |

EST-16-01362 | 6010 | 194.50 | 200.00 | 5.50 | 2.80 | 472.13 | 1.39 |

EST-16-01362 | 6000 | 249.80 | 252.75 | 2.95 | 2.60 | 471.37 | 1.11 |

EST-16-01362 | 5010 | 336.50 | 341.00 | 4.50 | 3.80 | 469.23 | 2.50 |

EST-16-01363 | 7000 | 346.00 | 350.00 | 4.00 | 3.06 | 286.59 | 1.30 |

EST-16-01363 | 6000 | 387.60 | 391.60 | 4.00 | 3.63 | 295.90 | 9.37 |

EST-16-01363 | 5050 | 403.00 | 411.35 | 8.35 | 6.40 | 299.77 | 8.35 |

EST-16-01364 | 6000 | 293.00 | 297.00 | 4.00 | 2.83 | 515.58 | 4.45 |

EST-16-01364 | 5010 | 345.00 | 348.00 | 3.00 | 2.60 | 521.82 | 1.96 |

EST-16-01365 | Uncorrelated | 131.20 | 138.00 | 6.80 | 2.87 | 220.90 | 5.60 |

EST-16-01365 | 7000 | 318.00 | 323.00 | 5.00 | 4.33 | 252.96 | 6.57 |

EST-16-01365 | 6000 | 329.20 | 333.00 | 3.80 | 3.29 | 254.67 | 5.39 |

EST-16-01365 | 5050 | 374.00 | 376.00 | 2.00 | 2.60 | 262.55 | 2.27 |

EST-16-01367 | 6500 | 224.20 | 235.95 | 11.75 | 7.55 | 503.19 | 3.67 |

Éléonore Property Exploration – The first surface drilling program since the acquisition of Éléonore was completed at two targets, Old Camp and Synee.

The Old Camp target is underlain by a diorite intrusion (Lac Ell diorite), located along a major north-east trending deformation zone that extends 6km from the Roberto deposit. The diorite is transgressed by several mineralized and veined shear zones observed in surface outcrop. The quartz-tourmaline shear-hosted veins are locally mineralized with pyrite-pyrrhotite-chalcopyrite +/- arsenopyrite and have not previously been tested at depth. A total of 1,063 grab and channel samples have been collected at Old Camp between 2002-2016. Anomalous gold values ranging from 0.1g/t to 1.0g/t Au are present in 168 samples and 53 samples have returned 1g/t to 6g/t Au with 3 samples between 10g/t to 20g/t Au. Anomalous copper between 0.5% to 3% is present in some samples.

The main targets of the drill program were to test:

- Two 230° trending deformation zones and the intersection with cross cutting structures;

- A series of IP anomalies that appear spatially along 050°/230°oriented shears; and

- The potential of the wacke-diorite contact.

A total of seven drill-holes were completed for a combined 3,308m, with lengths varying from 300m to 500m. The Ell Lake shear was intersected in all drill holes and continuity of the structure over 1km has been demonstrated. The structure has an average width of 5m and appears offset by a northwest fault. The shear zone is silicified and contains various amounts of quartz-tourmaline veining and is mineralized with locally developed semi-massive veins or patches of sulphide. A series of subordinate shears with quartz-tourmaline veins and strong tourmaline and locally chlorite alteration were intersected in the drill holes. Both gold assay and multi-element ICP data is pending and will be reported in the second quarter update.

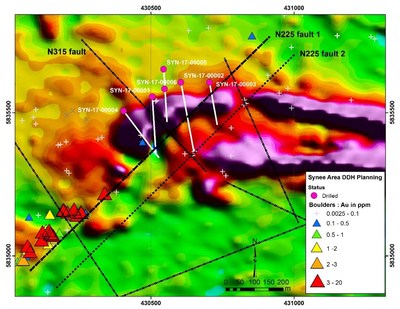

The Synee target area is expressed by a highly magnetic anomaly extending over 4km in length in a general east-west direction. Outcrops located near its center indicate the anomaly is caused by fine grained magnetite rich sediments. In 2015, a localized train of twenty mineralized boulders were found less than 1km, down the ice-flow direction, from the western most extremity of the iron formation. The boulders are a mix of magnetite rich sediments and paragneiss, with grab samples from the magnetite rich boulders ranging in grade from 1g/t Au to 16 g/t Au, and from the paragneiss ranging from 1g/t Au to 3g/t Au. The localized nature of the boulder train indicates a proximal source likely located in the area of the magnetic anomaly. It is a blind target with no surface outcrop and an overburden thickness ranging from 14 to 22m. Six holes were completed with 1,620m of drilling (Figure 8).

Gold assay results are pending and will be reported with the second quarter update.

LATAM

Cerro Negro

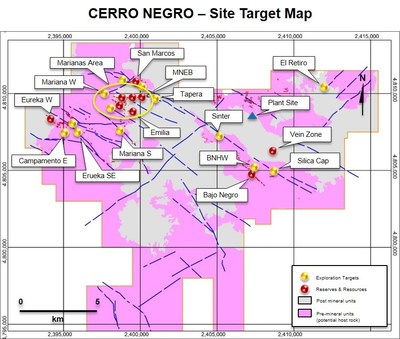

During the first quarter, drilling at the Mariana Norte Este-B, Este-A, San Marcos, Emilia, and Bajo Negro HW vein systems focused on resource conversion and expansion. Exploration drilling was completed at the El Retiro vein target while drilling at the Silica Cap target continued. A final condemnation hole related to the construction of a wind farm was also completed (Figure 9). A total of sixty-three holes were drilled for 20,731m.

Mariana Norte Este B

Drilling at Mariana Norte Este B was designed to support resource conversion by completing five-spot infill holes on 50m by 50m grids, as well as to expand resources eastward. During the first quarter, twenty-one holes were drilled totaling 7,933m. Gold assay results received encourage further exploration at the upper part of the vein. A number of promising banded quartz vein and quartz breccia intercepts have assays pending.

San Marcos

Drilling at San Marcos was designed to support potential resource conversion by completing five-spot infill holes on 50m by 50m grids, as well as to potentially expand mineral resources eastward. Although some intercept widths have been narrower than anticipated, the plunge of high grade mineralization has been extended to the east. Infill and step-out drilling at San Marcos is ongoing.

Bajo Negro Hanging Wall

Bajo Negro Hanging Wall is a secondary vein branch on the north, hanging wall side of the Bajo Negro vein system, dipping to the southwest, antithetic to the main vein. The Bajo Negro Hanging Wall structure was initially outlined in 2015 with drill holes that intercepted high gold grades, but pierced the structure at oblique angles.

Sixteen holes totaling 3,454m were completed in the first quarter. A high-grade ore shoot plunging to the SE has thus far been delineated along 200m, although some intercept widths have been narrower than anticipated (Figure 10).

Cerro Negro – Bajo Negro Hanging Wall (Long Section)

Mariana Norte Este A

Mariana Norte Este A is a secondary vein branch on the hanging wall of the Mariana Norte Este vein system, dipping to the south, antithetic to the main vein. Two step out holes totaling 624m were completed in the first quarter. Assay results are pending.

Emilia

Drilling completed in 2016 at the Emilia vein system highlighted additional potential approximately 120m to the southeast of current resources. Drilling to evaluate this extension is currently underway.

Representative results from Cerro Negro are shown in the table below. Full drill results and drill coordinates are available at the following:

Cerro Negro – Drill Results; Drill Coordinates

Hole ID | Deposit | From (m) | To (m) | Intercept (m) | True Width (m) | Au g/t | Ag g/t |

BDD-17001 | BNHW | 252.85 | 258.30 | 5.45 | 4.71 | 4.80 | 17.10 |

BDD-17003 | BNHW | ABORTED | |||||

BDD-17004 | BNHW | 215.50 | 217.90 | 2.40 | 2.20 | 26.10 | 128.50 |

BDD-17005 | BNHW | 162.15 | 163.95 | 1.80 | 1.71 | 2.00 | 24.80 |

BDD-17006 | BNHW | 161.80 | 167.00 | 5.20 | 5.01 | 20.80 | 30.10 |

BDD-17007 | BNHW | 205.55 | 206.80 | 1.25 | 1.19 | 6.10 | 54.00 |

BDD-17008 | BNHW | 105.80 | 108.90 | 3.10 | 2.95 | 4.50 | 14.90 |

BDD-17009 | BNHW | 102.85 | 112.00 | 9.15 | 7.97 | 3.10 | 11.00 |

BDD-17010 | BNHW | 242.00 | 248.50 | 6.50 | 5.94 | 7.10 | 35.00 |

MDD-17001 | MNEB | NSV | |||||

MDD-17002 | MNEB | ABORTED | |||||

MDD-17003 | MNEB | 371.00 | 387.90 | 16.90 | 12.73 | 5.29 | 12.20 |

MDD-17004 | MNEB | 430.10 | 433.85 | 3.75 | 2.79 | 22.41 | 88.50 |

MDD-17005 | MNEB | 520.10 | 527.40 | 7.30 | 4.43 | 7.25 | 15.23 |

MDD-17006 | MNEB | 395.50 | 400.35 | 4.85 | 3.65 | 3.87 | 5.89 |

MDD-17007 | MNEB | 310.95 | 311.45 | 0.50 | - | 16.10 | 20.00 |

MDD-17008 | MNEB | 494.70 | 503.45 | 8.75 | 5.99 | 2.59 | 6.22 |

MDD-17009 | MNEB | NSV | |||||

MDD-17010 | MNEB | 350.00 | 366.00 | 16.00 | 10.99 | 2.48 | 10.26 |

SDD-17001 | SM | 457.20 | 459.85 | 2.65 | 1.61 | 4.07 | 35.28 |

SDD-17002 | SM | 417.45 | 427.60 | 10.15 | 6.82 | 3.17 | 8.34 |

SDD-17003 | SM | 288.15 | 291.85 | 3.70 | 2.39 | 1.19 | 19.20 |

SDD-17004 | SM | 508.25 | 509.80 | 1.55 | 0.93 | 14.10 | 20.00 |

SDD-17005 | SM | 373.00 | 377.35 | 4.35 | 2.70 | 13.93 | 124.33 |

SDD-17006 | SM | 378.00 | 383.10 | 5.10 | 3.23 | 6.84 | 76.57 |

Regional Exploration

Silica Cap

Silica Cap is a northwest-trending zone of silica and argillic alteration 10.5km southeast of the Mariana Central area and 3.6km south of the processing plant. The zone is approximately 1.2km long and 50m to 150m wide and is characterized by structurally controlled, strata-bound, silica-flooded ignimbrite.

During the fourth quarter of 2016, a maiden drill program was completed with three holes. Intercept points from these holes indicated that the structure, defined by intercepts of colloform and vuggy silica, mineralized hydrothermal breccias, and elevated gold values, was intercepted obliquely.

A step-out program commenced in the first quarter in order to continue the evaluation of the system vertically and along strike. Four holes totaling 2,178m have thus far been completed.

Some delays were encountered at Silica Cap due to bad weather and poor drilling conditions in the upper, highly altered and fractured part of the system. Additionally, the reorganization of drilling resources to ensure adequate coverage for mineral reserve and mineral resource updates resulted in some delays at Silica Cap. Drilling is ongoing at this high priority target with plans underway to add a second rig in May.

Cerro Negro – Silica Cap (Plan View)

El Retiro

El Retiro is a strongly oxidized, southwest-northeast striking quartz vein-breccia system. Its orientation is not typical of Cerro Negro. The system is partly exposed at surface and hosted in felsic, moderately to strongly, illite-sericite altered ignimbrites. Previous rock chip sampling defined a number of discrete anomalies at surface, including 2g/t Au and 123g/t Ag. Anomalous As and Sb values in this sampling suggested the shallow level of an epithermal system exposed at surface.

A first pass drilling program was completed in the first quarter of 2017 with six holes totaling 1,537m. Drilling was unsuccessful in intersecting the quartz breccia identified at surface along most of the targeted trend. However, in the northeast area, drill hole ERDD-17002 intercepted a strongly oxidized silica breccia with anomalous gold values of up to 260ppm over six meters. Multi-element analyses are pending and results will be evaluated to determine if further work is warranted.

A summary of results from drilling at Silica Cap and El Retiro received during the first quarter of are presented in the table below:

Hole ID | Target | From (m) | To (m) | Intercept (m) | True Width (m) | Au g/t | Ag g/t |

SCDD-16001 | SC | 437.75 | 456.85 | 19.10 | 4.57 | 5.61 | 7.84 |

SCDD-16002 | SC | NSV | |||||

SCDD-16003 | SC | 274.25 | 278.30 | 4.05 | 1.10 | 10.60 | 6.96 |

SCDD-17001 | SC | 424.95 | 432.60 | 7.65 | 6.29 | 2.17 | 5.35 |

SCDD-17002 | SC | 400.25 | 401.80 | 1.55 | 1.35 | 3.03 | 7.98 |

SCDD-17003 | SC | 594.40 | 600.00 | 5.60 | 5.16 | 4.75 | 6.31 |

SCDD-17004 | SC | 379.50 | 385.00 | 5.50 | 4.91 | 2.48 | 6.73 |

ERDD-17001 | ER | 89.00 | 90.00 | 1.00 | 0.87 | 1.22 | 2.00 |

ERDD-17002 | ER | 49.00 | 55.65 | 6.65 | 6.03 | 0.26 | 1.90 |

ERDD-17003 | ER | 78.00 | 79.00 | 1.00 | 0.82 | 0.16 | 0.50 |

ERDD-17004 | ER | NSV | |||||

ERDD-17005 | ER | NSV | |||||

ERDD-17006 | ER | NSV | |||||

We have engaged a contractor to complete a helicopter-borne electromagnetic geophysical survey of the Cerro Negro property and expect it to be completed in the third quarter of 2017, when wind conditions are optimal.

A geochemical orientation survey over known mineralization was conducted during the fourth quarter of 2016 to determine if Mobile Metal Ion (MMI) technology can be utilized to explore beneath cover. Sampling was completed along two lines across covered portions of the Mariana Norte Este B and San Marcos veins. Preliminary interpretation of multi-element geochemical results indicate some rare earth and exotic metal concentrations may provide a distinct signature above buried mineralization.

Data evaluation continues, and a regional geochemical sampling strategy is currently being developed to evaluate the Silica Cap-Sinter-Tapera trend and to evaluate additional targets generated by the upcoming electromagnetic geophysical survey prior to reconnaissance drilling.

Peñasquito

Drilling to support the 2017 mineral resource update was completed in the fourth quarter of 2016. During the first quarter, mine exploration resources focused on a geotechnical drilling program and activities to support the 2017 mid-year mineral reserve and mineral resource update.

Central Block Generative Study

A target generation study extending across the Peñasquito district commenced in the fourth quarter of 2016, beginning with a 50km by 30km block centered over the Peñasquito and Concepción del Oro district. The initial phase of data compilation and acquisition, field studies, and geochemical orientation surveys was followed by a target generation study in March.

A total of thirteen targets were identified, including two properties (Noche Buena and Santa Rosa) which have been drilled previously by Goldcorp. All targets will be assessed for geological and economic potential over the coming months, moved up the resource triangle with further exploration, or moved out if they do not meet the relevant criteria for advancement.

Concurrent to the target generation work, a regional geochemical sampling program commenced in the first quarter. Rock chip and sediment samples have been collected on a widely spaced grid to begin evaluation of areas overlain by Tertiary and/or Quaternary cover. A geochemical review was undertaken in March to audit sample collection procedures and select the most appropriate analytical method before samples were dispatched to the laboratory.

Further geochemical orientation surveys are also planned to assess the effectiveness of sampling vegetation over covered areas. The objective is to aid in exploration efforts over the significant tracts of buried, but highly prospective, geology.

About Goldcorp

Goldcorp is a senior gold producer focused on responsible mining practices with safe, low-cost production from a high-quality portfolio of mines.

Scientific and technical information in this press release relating to exploration results was reviewed and approved by Sally Goodman, PhD, PGeo, Director, Generative Geology for Goldcorp, and a "qualified person" as defined by NI 43-101. Information on data verification performed on the mineral properties mentioned in this news release that are considered to be material mineral properties to the Company are contained in Goldcorp's most recently filed annual information form and the current technical report for each of those properties, all available at www.sedar.com.

Quality Assurance/Quality Control

Quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the core and reverse circulation sample strings. The results of the control samples are evaluated on a regular basis with batches re-analysed and/or resubmitted as needed. All results stated in this announcement have passed Goldcorp's quality assurance and quality control ("QA/QC") protocols.

Cautionary Note Regarding Forward Looking Statements

This press release contains "forward-looking statements", within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, or the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under the provisions of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Goldcorp. Forward-looking statements include, but are not limited to, statements with respect to the future price of gold, silver, copper, lead and zinc, the estimation of mineral reserves and mineral resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, targeted cost reductions, capital expenditures, free cash flow, costs and timing of the development of new deposits, success of exploration activities, permitting time lines, hedging practices, currency exchange rate fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, timing and possible outcome of pending litigation, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "should", "might" or "will", "occur" or "be achieved" or the negative connotation thereof.

Forward-looking statements are necessarily based upon a number of factors that, if untrue, could cause the actual results, performances or achievements of Goldcorp to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Goldcorp will operate in the future, including the price of gold and other by-product metals, anticipated costs and ability to achieve goals. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, among others, gold and other by-product metals price volatility, discrepancies between actual and estimated production, mineral reserves and mineral resources and metallurgical recoveries, mining operational and development risks, litigation risks, regulatory restrictions (including environmental regulatory restrictions and liability), changes in national and local government legislation, taxation, controls or regulations and/or change in the administration of laws, policies and practices, expropriation or nationalization of property and political or economic developments in Canada, the United States and other jurisdictions in which Goldcorp does or may carry on business in the future, delays, suspension and technical challenges associated with capital projects, higher prices for fuel, steel, power, labour and other consumables, currency fluctuations, the speculative nature of gold exploration, the global economic climate, dilution, share price volatility, competition, loss of key employees, additional funding requirements and defective title to mineral claims or property. Although Goldcorp believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Goldcorp to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to international operations including economic and political instability in foreign jurisdictions in which Goldcorp operates; risks related to current global financial conditions; risks related to joint venture operations; actual results of current exploration activities; actual results of current reclamation activities; environmental risks; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold and other by-product metals; possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; risks related to the integration of acquisitions; accidents, labour disputes; delays in obtaining governmental approvals or financing or in the completion of development or construction activities and other risks of the mining industry, as well as those factors discussed in the section entitled "Description of the Business – Risk Factors" in Goldcorp's most recent annual information form available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Although Goldcorp has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are made as of the date hereof and, accordingly, are subject to change after such date. Except as otherwise indicated by Goldcorp, these statements do not reflect the potential impact of any non-recurring or other special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after the date hereof. Forward-looking statements are provided for the purpose of providing information about management's current expectations and plans and allowing investors and others to get a better understanding of Goldcorp's operating environment. Goldcorp does not intend or undertake to publicly update any forward-looking statements that are included in this document, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

SOURCE Goldcorp Inc.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Goldcorp Inc.mehr Nachrichten

| Keine Nachrichten verfügbar. |

Analysen zu Goldcorp Inc.mehr Analysen

Aktien in diesem Artikel

| Genpact LtdShs | 46,83 | -1,43% |

|