|

18.01.2023 13:00:00

|

Mako Mining Provides Q4 2022 Production Results with Record Gold Sales of 9,956 oz and Total Silver Recovered of 16,268 oz

VANCOUVER, BC, Jan. 18, 2023 /PRNewswire/ - Mako Mining Corp. (TSXV: MKO) (OTCQX: MAKOF) ("Mako" or the "Company") is pleased to provide fourth quarter 2022 ("Q4 2022") production results from its San Albino gold mine ("San Albino") in northern Nicaragua, which is the sixth full quarter of production results since declaring commercial production on July 1, 2021. Financial results for Q4 2022, including detailed reporting of our operating costs, are expected to be released in April.

Q4 2022 Production Highlights

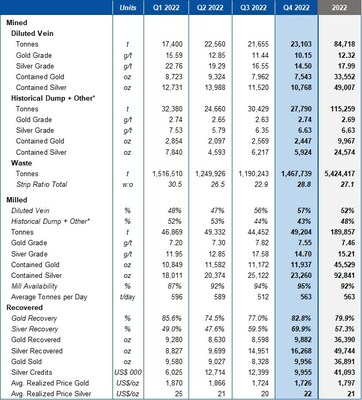

- 50,893 tonnes mined containing 9,990 ounces of gold ("oz Au") at a blended grade of 6.11 grams per tonne gold ("g/t Au") and 16,692 ounces of silver ("oz Ag") at a grade of 10.20 grams per tonne silver ("g/t Ag")

- 23,103 tonnes mined containing 7,543 oz Au at 10.15 g/t Au and 10,768 oz Ag at 14.50 g/t Ag from diluted vein material

- 27,790 tonnes mined containing 2,447 oz Au at 2.74 g/t Au and 5,924 oz Ag at 6.63 g/t Ag from historical dump and other mineralized material above cutoff grade ("historical dump + other")

- 28.8:1 strip ratio overall which includes accelerated waste development of the West and the Central Pit ("Arras Zone")

- 49,204 tonnes milled containing 11,937 oz Au at a blended grade of 7.55 g/t Au and 18,408 oz Ag at 11.64 g/t Ag

- 57% and 43% from diluted vein and historical dump and other, respectively

- 563 tonnes per day ("tpd") milled at 95% availability

- Recoveries of 82.8% and 69.9% for gold and silver, respectively, in Q4 2022

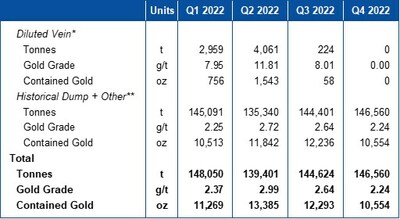

- 146,560 tonnes in stockpile containing 10,554 oz Au at a blended grade of 2.24 g/t Au

- 9,882 oz Au and 16,268 oz Ag recovered

- 9,956 oz Au and 9,955 oz Ag sold

Akiba Leisman, Chief Executive Officer of Mako states that, "Q4 2022 was a strong quarter with record gold sales and record silver recovered. The metallurgical challenges we experienced in Q2 and Q3 2022 are now firmly behind us, and the Company intends to continue optimizing the plant, with the expectation that it will be operating consistently at 600 tonnes per day ("tpd") later in Q1 2023. Throughput reached 600 tpd 14 times during the quarter, which clearly demonstrates the capability of running 20% above the plant's original 500 tpd nameplate capacity. Operating cash flow was robust at an average realized price of $1726 per ounce, where we will report AISC substantially below that of Q3 2022. Now that the gold price is 10% higher than what was realized in Q4 2022, our balance sheet will accelerate its strengthening, even after budgeting nearly $10 million of exploration expenditures for 2023."

Mining

The mine averaged 553 tpd of diluted vein and historical dump + other material in Q4 2022 with a strip ratio of 28.8 which included accelerated waste development of the West and the Central Pit. The current stockpile is 146,548 tonnes containing 10,292 oz Au at 2.18 g/t Au.

The average grade of the diluted vein was 10.15 g/t Au during the quarter. A combination of geological mapping, additional lab testing, and new procedures implemented by our mine geologist have all contributed to improved mining selectivity, which limits the amount of preg-robbing material being fed to the plant, thereby enhancing recoveries. New blending processes allowed the mill to maintain high throughput without sacrificing recovery.

Lastly, initial development for a second waste dump began during the quarter with an initial capacity of 6 million tonnes ("Mt") which can eventually be expanded to 23 Mt.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q4, 2022, the plant has been averaging 563 tpd at 95% availability (see Table 1). In Q4 2022 the plant processed 57% diluted vein material and 43% historical dump + other material to achieve an average blended grade of 7.55 g/t Au and 14.70 silver. The recovery for the quarter was 82.8% for gold and 69.9% for silver for the quarter. (See Table 1)

The gold recovery improvement from 77.0% in the third quarter to 82.8% in the fourth quarter was a result of the processing improvements implemented during the third quarter. A second carbon striping vessel was commissioned during the fourth quarter. The second vessel allows for more efficient carbon stripping and will result in reduced precious metal in the carbon circuit inventory. The retention screens in the CIL tanks were replaced with new screens during December. The new screens will improve the CIL tank profile, resulting in reduced metal concentrations in the tails solutions, which will improve overall circuit recovery.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and certain expectations and assumptions, including that Q4, 2022 detailed operating costs and financial results will be available in March 2023; the additional optimizations noted may improve recoveries further; and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that the Company is not successful in operating San Albino profitably and/or funding its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company's exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q4 2022 production results at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-provides-q4-2022-production-results-with-record-gold-sales-of-9-956-oz-and-total-silver-recovered-of-16-268-oz-301724508.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-provides-q4-2022-production-results-with-record-gold-sales-of-9-956-oz-and-total-silver-recovered-of-16-268-oz-301724508.html

SOURCE Mako Mining Corp.

Der finanzen.at Ratgeber für Aktien!

Der finanzen.at Ratgeber für Aktien!

Wenn Sie mehr über das Thema Aktien erfahren wollen, finden Sie in unserem Ratgeber viele interessante Artikel dazu!

Jetzt informieren!

Nachrichten zu Golden Reign Resources Ltd Registered Shsmehr Nachrichten

| Keine Nachrichten verfügbar. |